Home Security Credit line compared to. Refi: Which makes Far more Experience inside Economy?

Dienstag, 24. September 2024 22:21

Tapping their house’s guarantee with an effective HELOC are a payment-effective option in the present housing market. Some tips about what you should know.

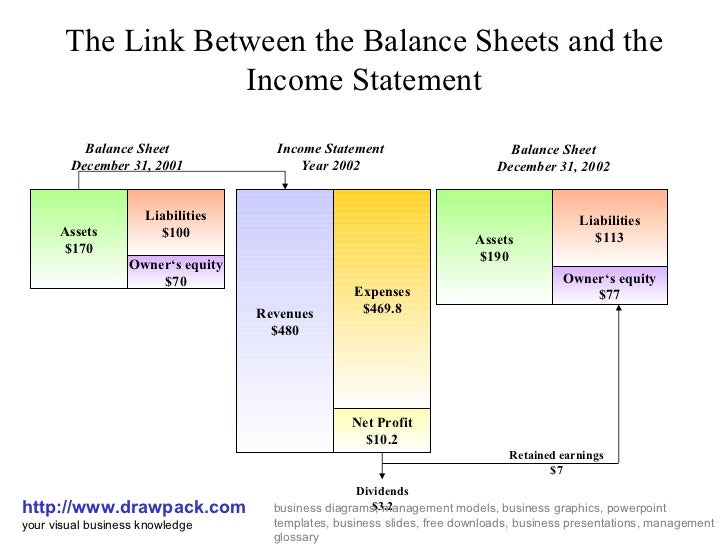

Homeownership has its own positives. A major one is the capacity to grow your riches because of the building security, which is the difference between the balance of mortgage and the residence’s appraised really worth.

The easiest way to accessibility the house’s guarantee is to try to sell. Yes, you have cash in your wallet, but you’ll also have the newest questionable — payday loan companies in Carlton Alabama and you will stressful — task to find another location to real time; not a great disease to be in in the midst of the present rising household viewpoints. If you aren’t seeking flow, you could potentially tap their home’s equity as a result of possibly an earnings-away re-finance, a reverse financial (whenever you are many years 62 otherwise elderly and now have paid off the mortgage), a property guarantee financing or a house guarantee credit line, otherwise HELOC.

With 30-12 months fixed home loan pricing around 5%, substitution your current home loan with a brand new that compliment of a cash-aside re-finance might not be the absolute most advantageous solution, and a reverse home loan cannot implement unless you’re years 62 or earlier. That renders house guarantee funds , particularly HELOCs, a more popular solution in the modern economy . Here is what you must know regarding the HELOCs.

What exactly is a good HELOC?

A beneficial HELOC is a type of household equity mortgage enabling homeowners to access its security in the way of a beneficial revolving line of credit. […]

Thema: paydayloanalabama.com+carlton get a cash advance | Kommentare deaktiviert für Home Security Credit line compared to. Refi: Which makes Far more Experience inside Economy? | Autor: admin