Donnerstag, 3. Oktober 2024 16:02

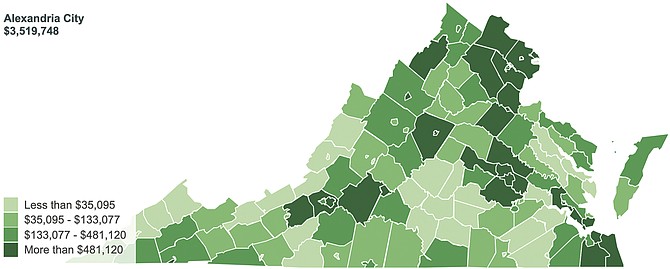

Personal loan rates can vary according to your credit score

*Investigations rates based on that loan of $29,100000 to own a good five-season loan name. Warning: this review rate holds true simply for this case that will maybe not include all the costs and you will charges. Additional terms and conditions, fees or any other financing wide variety might result when you look at the a different sort of comparison price, Cost best since . See disclaimer.

What is actually a personal bank loan?

A consumer loan are a financial tool where you borrow funds off a lender or standard bank, to make typical repayments with appeal across the financing term (always 7 decades).

When you are signature loans is actually a shorter flexible kind of credit than simply a charge card and do not give you the exact same advantages, the interest rates to your personal loans are generally dramatically reduced than simply the individuals into playing Watsonville payday loans paydayloancalifornia.org cards.

The majority of people play with signature loans to pay for things such as a great escape, relationship, home home improvements or for consolidating personal credit card debt.

Which fundamentally form brand new sensed trustworthiness of the fresh new borrower you can expect to influence what interest the financial institution eventually charges to the mortgage.

Lenders will usually go through the borrower’s credit score so you can adjudge their sincerity, with the lower rates constantly booked of these which have expert fico scores.

Additional factors may impact the interest, such as the amount borrowed, loan years or whether the mortgage try protected, unsecured, fixed-rate or varying-rate.

Simple tips to compare signature loans

There are lots of avenues about how to talk about when trying to an excellent competitively-cost consumer loan, but these are a couple of of better facts to consider:

[…]