Dienstag, 5. November 2024 14:00

Which are the Gurus & Downsides From financing Modification?

While unable to make your home loan repayments, youre from by yourself. You’re provided looking to financing amendment. The consumer Monetary Security Bureau (CFPB) refers to financing modification just like the a modification of the loan terminology . Used, financing adjustment takes some forms-from waiving charges & charges to stretching that point of cost.

Mortgage variations may help care for financial trouble. It can be the thing that makes your repayments reasonable. That said, financing amendment is not necessarily the top road give in just about Indiana installment loans any situation. You can find one another pros and cons. On this page, all of our Las vegas mortgage loan modification attorney discusses the benefits and disadvantages of getting financing modification for the mortgage.

Loan mod: The huge benefits

There are few things a great deal more stressful than just losing at the rear of on your own mortgage payments. Financing amendment offers a prospective substitute for Nevada homeowners exactly who was unable to make most recent payments. Listed here are three gurus of getting a mortgage loan modification from inside the Las vegas:

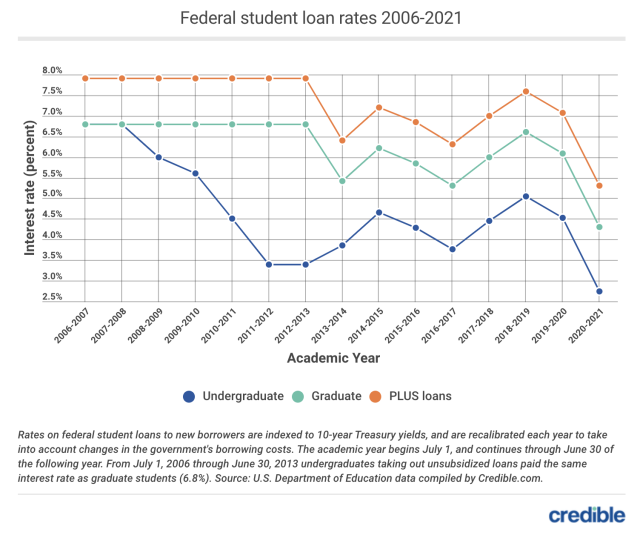

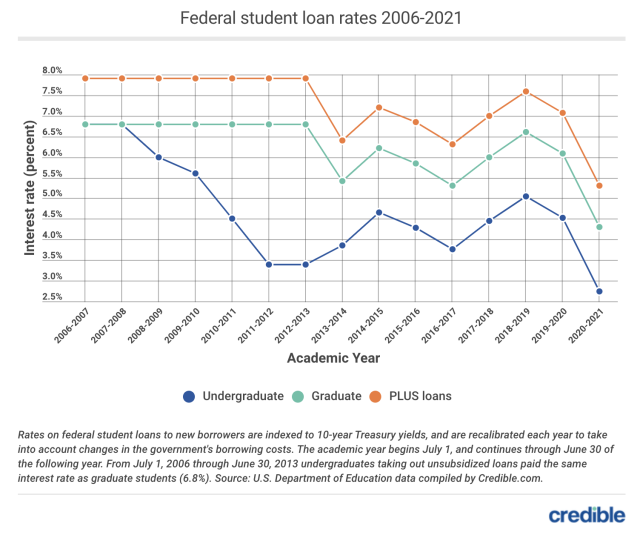

Pro #1-You will be Capable of getting a lower life expectancy Payment: Firstly, an important benefit of a mortgage loan modification is that you might be able to qualify for a lower life expectancy, less expensive payment per month. This might be attained from inside the around three basic implies: 1) Repayment months can be offered, 2) The pace is generally shorter, and/otherwise step 3) Certain fines is forgiven downright. Which have a mortgage modification, you might be inside a much better position making your own complete payments every month. […]