Domestic Guarantee Lines of credit: Just how to Use & Play with

Property guarantee personal line of credit (HELOC) are a beneficial revolving line of credit removed up against your own home’s collateral. The absolute most you might borrow will be based upon your security, you could borrow shorter and simply spend focus on which you’ve borrowed.

In this post

- What is actually an excellent HELOC?

- Exactly how HELOCs Work

- Best Uses for a beneficial HELOC

- Choosing a loan provider

- Trying to get an excellent HELOC

- Benefits & Downsides of HELOCs

- Is actually a great HELOC Good for you?

- HELOCs against. Family Guarantee Fund

- Frequently asked questions Regarding HELOCs

Property equity credit line, or HELOC for short, is actually a loan that makes use of the new security you attained in your house once the security. Generally speaking, an excellent HELOC was computed by the subtracting the total amount you borrowed from towards your mortgage regarding doing 85% of your own appraised value of your property.

As accepted loan amount might still confidence your debt-to-earnings (DTI) ratio as well as your credit rating, what you owe is present whenever you need it, while pay just attract toward amount your use.

not, an effective HELOC might not be a good choice for everybody, possible put you prone to losing https://paydayloancolorado.net/grand-junction/ your home should you not be able to make payments. Before taking you to away, see how a good HELOC really works and you will if the installment framework is acceptable for your disease.

Secret Takeaways

To get a good HELOC, you’ll generally speaking you want at least fifteen% of one’s home’s security, a significant credit score and you may a qualifying obligations-to-earnings (DTI) proportion.

HELOCs, offered its straight down interest rate than many other money, can be used for individuals requires eg home improvements, debt consolidation otherwise disaster expenses.

What is actually a property Guarantee Credit line (HELOC)?

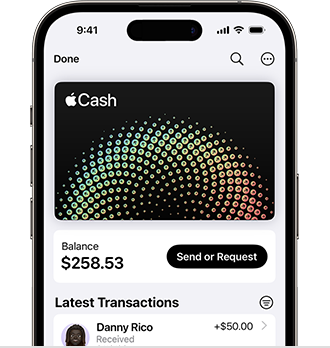

A beneficial HELOC try a great revolving credit line covered by the residence’s guarantee. Lenders will appear at your credit rating and you can financial obligation-to-income (DTI) ratio and ensure you have got about 15% guarantee of your home so you can qualify. After that, it ount you can acquire, and you will withdraw one amount around otherwise around your own recognized restriction having fun with good checkbook otherwise a charge card linked to this new account.

HELOCs normally have a blow months, a period of time when you can use about account. Once this several months is actually up, you will have to replace their line of credit or initiate paying off the quantity your debt.

HELOCs generally have a variable interest rate, which means that your costs can change over the years. A varying rates could work in your favor when it goes down, however, if it is right up you can also no further manage to settle, you face the risk of dropping your property.

Your home is collateral towards HELOC, when you standard into the money, the financial institution usually takes your house making right up for this. If you decide to offer your house, try to pay-off their HELOC within the process.

How do HELOCs Functions?

While recognized to possess an excellent HELOC, lenders will agree your for an optimum number that is predicated on multiple products, also how much cash equity you’ve got of your home along with your credit score. Brand new collateral of your home refers to the property’s full worth, without whatever you currently owe into mortgage loans and you can home collateral loans. HELOCs has an application process similar to that of a normal mortgage, that involves thinking about the total economic photo.

The financing toward a good HELOC revolves. Identical to a charge card, because you pay the primary, what you owe try quicker and you may offered borrowing from the bank replenished. Specific plans has restrictions how you can make use of this type of finance, having minimum detachment wide variety and you can outstanding equilibrium caps. Particular lenders require a first improve if range is made. With respect to the financial, you might use their HELOC by composing a, having fun with a great debit card which is tied to the newest membership or simply going loans to your family savings.