Newest mortgage prices as of : Prices drop, heading back off on the 6%

Glen Luke Flanagan is actually a good deputy editor at Luck Recommends just who concentrates on financial and bank card articles. Their earlier spots were deputy publisher ranks at Usa Today Strategy and you can Forbes Mentor, including older author on LendingTree-all the concerned about credit card advantages, credit scores, and relevant subjects.

Benjamin Curry ’s the movie director regarding stuff on Luck Advises. With well over twenty years away from journalism feel, Ben keeps commonly protected monetary avenues and private money. In past times, he had been an elderly publisher during the Forbes. Prior to one to, he worked for Investopedia, Bankrate, and you may LendingTree.

The current average rate of interest for a fixed-rates, 30-seasons compliant home loan in america are six.062%, with respect to the latest study provided by mortgage tech and you will analysis business Optimal Bluish. Read on to see mediocre costs a variety of form of mortgage loans and just how the current rates compare to the final said day earlier in the day.

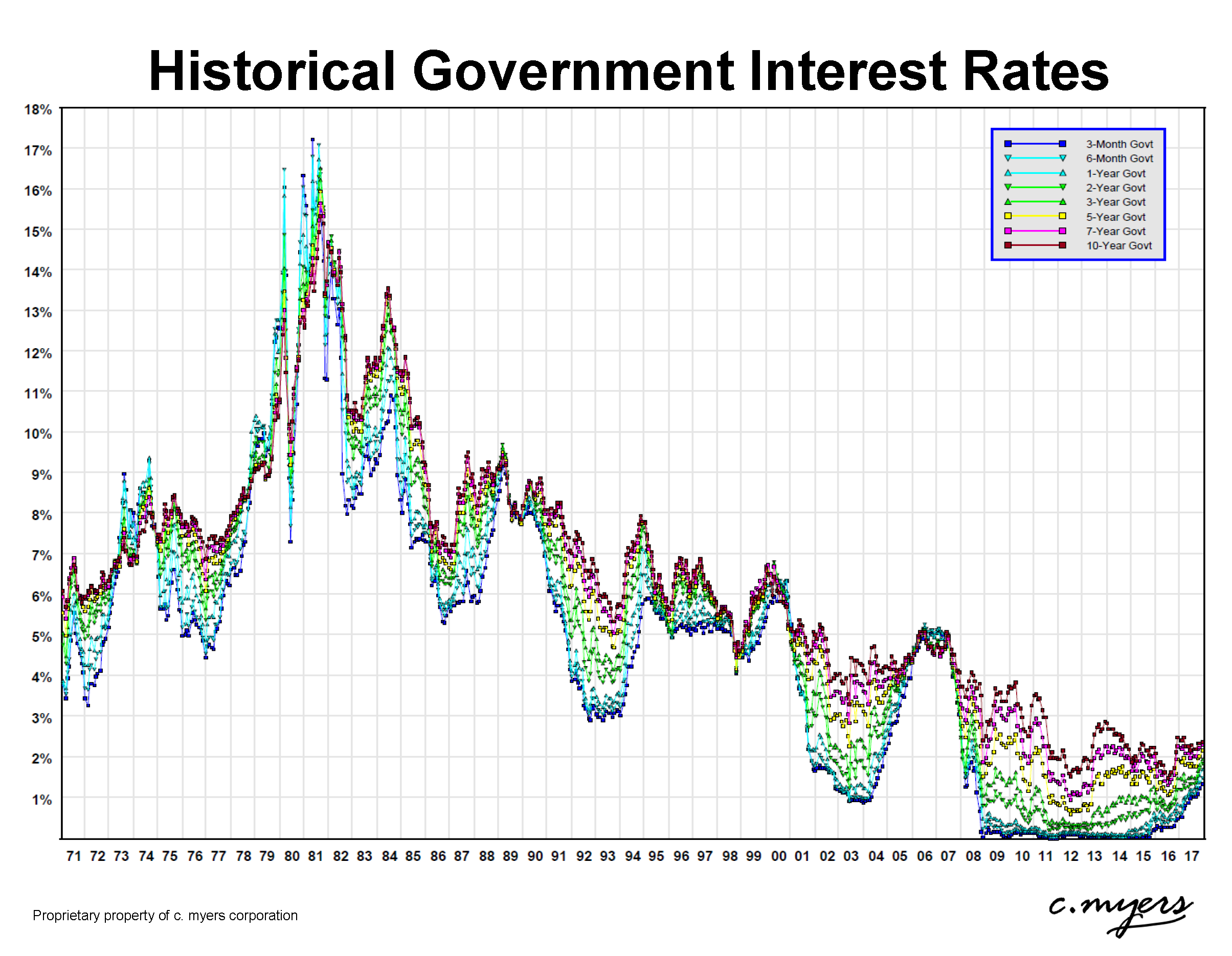

Historic home loan prices graph

Note, there’s a lag of a single working day into the analysis reporting, meaning that the most current speed currently is what new graph reveals getting Sep 20.

30-seasons conforming

The average interest, for every the quintessential current research offered at this writing, is 6.062%. Which is down out-of six.088% the past claimed day earlier in the day.

30-season jumbo

What is a good jumbo financial otherwise jumbo financing? This means, they exceeds the absolute most to possess a routine (conforming) mortgage. Fannie mae, Freddie Mac, as well as the Federal Construction Finance Agencies put that it restrict.

The average jumbo financial rate, for every single probably the most most recent data readily available during this composing, are 6.347%. That is off out-of 6.542% the very last reported day earlier in the day.

30-year FHA

This new Federal Housing Management brings home loan insurance policies to particular lenders, plus the loan providers subsequently could possibly offer the consumer a much better price for the issue particularly to be able to be eligible for good mortgage, possibly and make an inferior down payment, and maybe taking less rate.

The average FHA mortgage rates, for each and every many latest investigation readily available during this composing, try 5.825%. Which is off from 5.869% the very last advertised day early in the day.

30-12 months Va

A good Va mortgage is out there by the an exclusive lender, nevertheless the Agencies of Veterans Circumstances pledges part of it (cutting risk towards lender). He or she is accessible if you are an effective U.S. armed forces servicemember, an experienced, otherwise an eligible surviving mate. Eg financing can get both allow acquisition of a home which have no advance payment after all.

An average Va mortgage rate, per the quintessential current studies offered as of this creating, is actually 5.487%. Which is right up regarding 5.476% the very last advertised time earlier.

30-seasons USDA

The brand new U.S. Agency of Agriculture operates applications to assist reasonable-income individuals reach homeownership. Such as finance can help U.S. people and you will qualified noncitizens buy a home no downpayment. Observe that there are stringent requirements so that you can qualify having a USDA financial, like earnings constraints additionally the house staying in an eligible outlying area.

The common USDA financial rates, for each and every the essential latest studies readily available as of this writing, is actually 5.850%. Which is down out-of 5.892% the final stated time prior.

https://paydayloanalabama.com/evergreen/

15-season mortgage rates

A great 15-seasons mortgage have a tendency to typically imply high monthly installments but less notice paid across the longevity of the borrowed funds. An average rates to have good fifteen-season conforming mortgage, for each many newest research offered during that writing, are 5.177%. Which is down away from 5.260% the very last stated day earlier.

How come mortgage rates transform?

While you are yours borrowing from the bank character have a tendency to definitely change the financial rate you might be offered, there are also products exterior the manage that affect their price. Some points is: