In the event the financing is actually leaving forbearance and you are trying re-finance, you are likely to be able to – ultimately

Refinancing after forbearance

How long you may be expected to waiting varies according to brand new issues of one’s pecuniary hardship and if you kept with any planned costs utilized in the forbearance package.

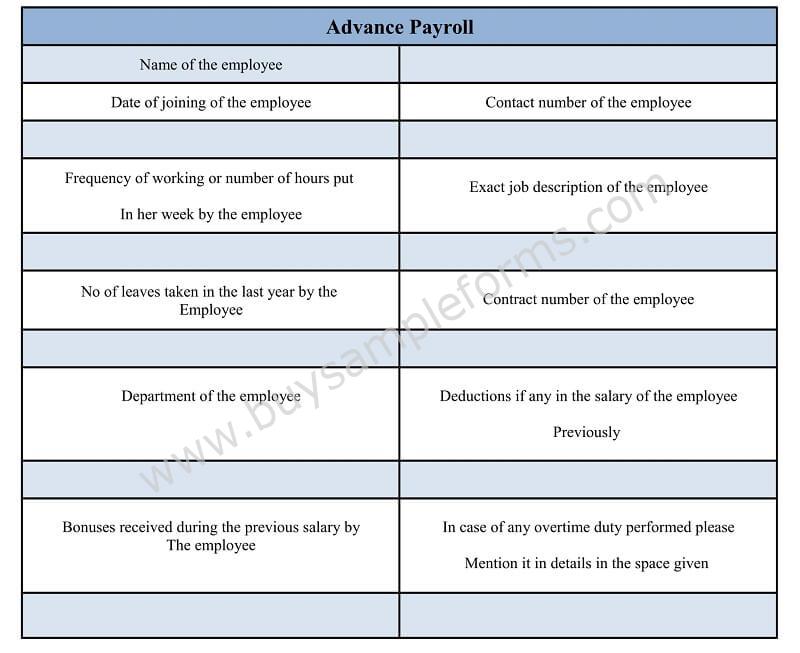

For people who entered forbearance on account of COVID-19, you usually need not waiting anyway, for as long as you have made their current 3 to 6 payments timely. The latest table less than reveals the details:

not, if the issues was not related so you can COVID, you could be caught looking forward to to 12 months in advance of you could potentially re-finance.

Refinancing after loan modification

If you have started through the mortgage loan modification processes with your financial, you’ll be able to normally have to wait a dozen so you can two years after the loan modification so you’re able to qualify for an excellent re-finance. But not, in the event your loan mod is actually after you exited a good COVID-19 forbearance system, it’s not necessary to waiting, as long as you made the past half dozen so you can twelve repayments of the loan mod on time.

Choices in order to refinancing which have later money

If you’re unable to refinance the mortgage, you may have a number of choice to-fall right back on. Your appropriate move to make is determined by your home loan method of, exactly how prior-owed you are along with your lender’s choices. Although some ones choice allows you to stay-in their household, others do not.

Check with your bank immediately to discuss the choices and then methods. A beneficial HUD-recognized property counselor can also promote further guidance.

Repayment plan

Having a cost plan, their financial offers a structured contract in order to satisfy their later otherwise outstanding mortgage payments. Including purchasing the main earlier-owed amount with your monthly payments through to the loan try newest. The financial ount until the stop of your own mortgage title.

Typing a payment plan allows you to stay-in our home and you may render the loan current if you’re unable to refinance the newest outstanding mortgage.

Financial forbearance

If you are sense pecuniary hardship – death of a position, issues, sheer emergency and other occurrences – you can even qualify for home loan forbearance. With a home loan forbearance, your bank will

Remember that forbearance does not take away the paused otherwise smaller payments. Focus into financing will continue to accrue, and your bank can give alternatives for recuperating the lower or paused quantity.

Financial amendment

Home financing modification reduces your payment per month by the switching this new conditions of mortgage. Particularly, their personal loans Chicago financial could possibly get customize your home loan because of the stretching the mortgage identity, reducing the interest otherwise decreasing the prominent harmony.

It’s not hard to mistake loan modification with refinancing, but the a few aren’t the same. Having that loan modification, it is possible to continue to have a comparable home loan and you can financial but with modified words. Concurrently, you might not shell out costs otherwise settlement costs to modify your loan. On the other hand, for many who re-finance, you’ll have yet another mortgage one to pays off current financial balance – regardless if you will need to pay refinance closing costs.

Brief profit

When your financial is actually underwater – when you are obligated to pay regarding your loan compared to the house is value – you might believe a primary purchases. An initial business enables you to promote your house for cheap than simply it is worth, and your bank welcomes the newest continues of business because installment of your financing, usually instead of your being required to built the complete mortgage matter. If you’re a preliminary income commonly negatively perception your own borrowing, the results would-be faster dangerous than what you would get a hold of having a foreclosures on your own number, and you could also have some of debt forgiven.