How-to finance a house generate having a preexisting home loan

With the proper group, structure financing is a lot easier than just do you consider. Here is how.

Homeseekers usually believe that building another type of home is perhaps not a keen alternative once they do not have cash to build property and you will are currently purchasing a home loan on their existing household. Whatsoever, who wants to pay a couple mortgages throughout the structure techniques?

The good news is, you can find selection offered one to reduce the count you are going to need to pay when you are your brand new house is are oriented and you will explain the procedure for being qualified for a loan to pay for building your ideal house.

Stop taking out a normal financial oneself

One of the biggest homebuilding hurdles just in case you have a home loan was convinced they have to remove a different sort of old-fashioned mortgage because of their new house. While building a property, or even to get a great pre-build household, a normal mortgage is not necessarily the proper alternative. Taking a traditional home loan was tough, especially if you try to do it on your own, as lenders try unwilling to mortgage money to own property one isnt yet , built. Therefore, it is advisable to secure that loan equipment designed for new domestic construction.

Our TJH party will help you find the correct household services and connect you to financial support options to have the ability.

Rather, see a casing-to-long lasting mortgage

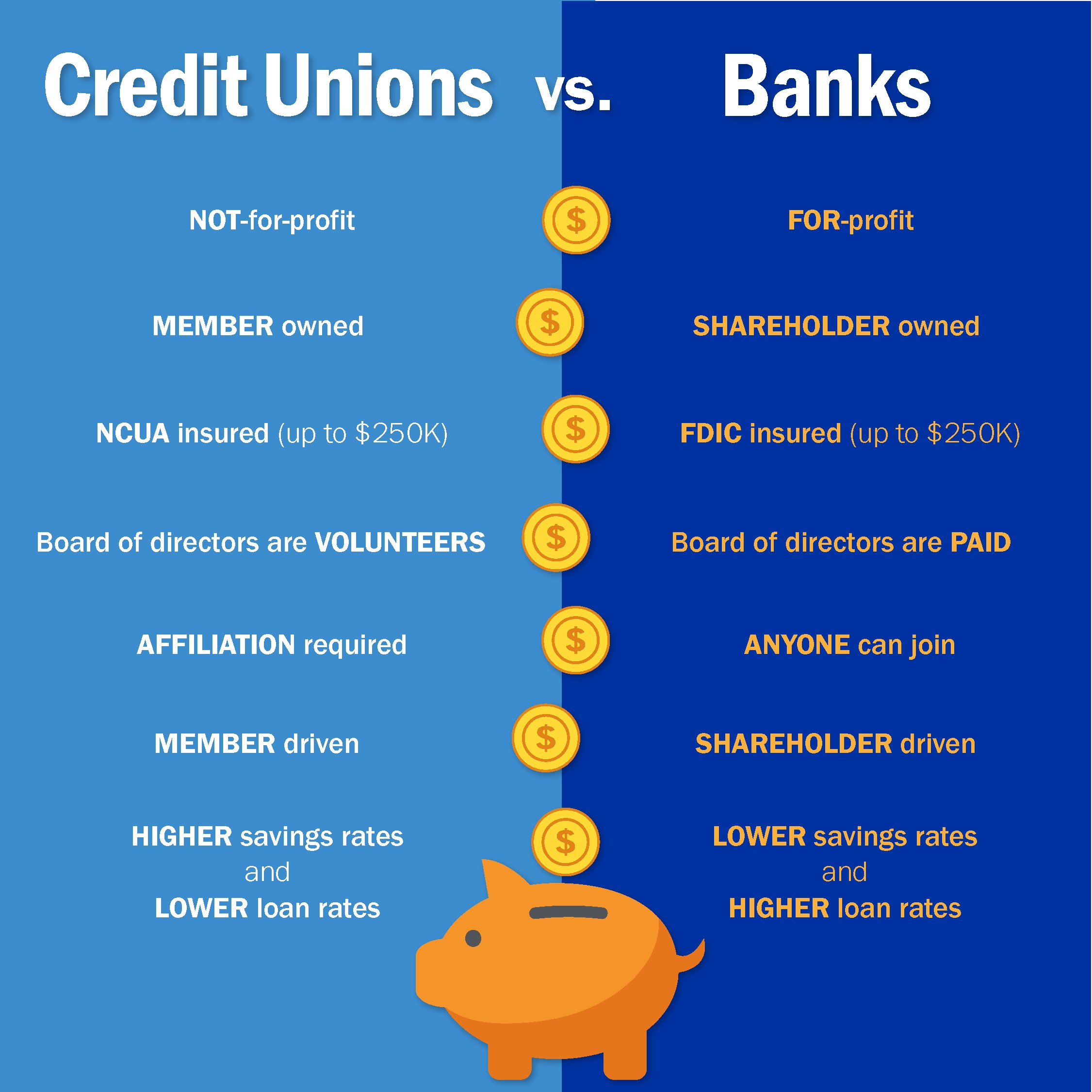

Construction-to-long lasting finance off a beneficial TJH common financial, such as for instance Kinecta Government Credit Union, take away the need to pay a couple of mortgage loans while your brand-new home will be situated.* Repayments be a little more reasonable because they’re attract-only, in accordance with the an excellent amount borrowed. From the draw processes, the financial institution disperses financial support so you’re able to TJH just like the improvements is made into the your property. Once a final house evaluation and you may/otherwise certificate of occupancy, the borrowed funds transforms to home financing and you can dominant payments initiate.

One of the primary issues we come across is the fact we consider they want to be eligible for one or two land and you can shell out one or two mortgage loans. The reality is that they’ll not need to create home financing commission with the brand new home up to it’s done. At that time, they could offer the old domestic and implement one amount into new loan.

Go with a loan provider you to focuses primarily on home-building

For those who borrow out of a loan provider that is amateur into the homebuilding, you can have an extra financing closure to suit your home loan from the a high interest shortly after your home is complete.

All of our preferred loan providers promote structure-to-permanent finance having a single-big date alongside secure their rate. Consequently, it can save you many when you look at the extra settlement costs.

Lenders for example Kinecta together with develop your interest rate in advance of structure begins, which rate will continue to be an identical because loan transforms so you can a classic financial. Hence, it’s not necessary to value rate of interest nature hikes leading to a top-than-questioned payment per month on your new house. You understand just what you’ll pay in the framework phase and you will shortly after move-in.

Find a suitable loan for your house make

In order to money strengthening the home of the ambitions, you want money you to surpasses what is actually given by antique mortgages. With your popular loan providers, it’s possible to have the means to access the best house, right in which you are interested, and capital you need to get indeed there.

The well-known lenders render portfolio jumbo money, that are alot more versatile, basically on much lower interest levels, than compliant money that has to follow the factors set up lay from the Freddie Mac and you may Fannie mae.

The prominent lenders along with work on customers to discover the right financial and you can conditions because of their certain state. They give investment in accordance with the upcoming appraised worth of their house once it is founded, which may cause all the way down repayments, according to appraised value proportion into the established financial principal.

Decide for a conclusion-to-end solution

Securing a housing-to-permanent financing are a difficult procedure, requiring homeseekers to prove their house-building endeavor is actually lowest-chance into financial. TJH’s reliable construction times, price make certain, end-to-end process, and you may reputation as the biggest solitary-package, substitute for homebuilder in the united states give lenders a great amount of cover in greenlighting assembling your project.

I likewise have house concierge characteristics for those searching for an effective lot otherwise homesite about coolest neighborhoods in the Southern area California, North California, the newest Pacific Northwest, Tx, and Washington. We’re going to pick your an off-field property on which to build the new house for many who do not already have an effective homesite. All of our popular lenders bring structure investment that will range from the prices of your land in your loan, eliminating the need to safe an alternative homes mortgage.

Resource an excellent TJH home create is easier and a lot more achievable than of numerous comprehend. You can expect a just about all-in-one loan that have loans in Coventry Lake a-one-time romantic. This avoids pressure and you may high priced deal costs normally associated with the independent structure-to-permanent rollover finance. Rather, our very own process is the same as a timeless mortgage, simply before our home getting centered.

*Kinecta Government Borrowing from the bank Connection and Thomas James House aren’t connected. Subscription standards apply. NMLS (Nationwide Mortgage Credit Services) ID: 407870. Susceptible to borrowing and you may assets acceptance. Prices, program terms, and you may requirements is actually susceptible to change without notice. Not totally all products are found in the claims and for all financing wide variety. Almost every other restrictions and constraints may implement. The genuine terms of the mortgage will depend upon the particular properties of your loan deal, the fresh new applicant’s credit rating, and other economic activities that may apply.