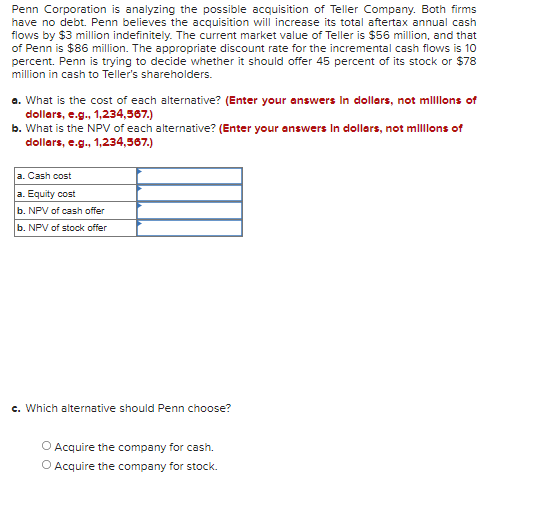

Ways to get A home loan Pre-Approval inside the 5 Tips

Delivering an effective preapproved to own home financing was a critical very first circulate yourself to purchase techniques. That it initial step besides can help you know your finances however, and additionally makes you a very attractive visitors in order to manufacturers. Here’s an intensive guide on precisely how to have one in the 5 steps:

1. https://paydayloanalabama.com/anderson/ Collect Relevant Papers

Upfront brand new preapproval process, gather extremely important economic papers. Really loan providers typically wanted proof terrible month-to-month income (instance pay stubs), work background, taxation returns, credit score, and you will details about their property and you will monthly loans repayments (for example car loans, bank comments, or other monthly payments). With these data prepared and you can in a position often streamline the program procedure, so it is less and a lot more efficient.

2. Rating Pre-approved (Sure, today!)

As soon as your papers is in purchase, feel free-score preapproved to possess home financing. Of many homebuyers make the error off house google search in advance of protecting an effective preapproval letter, resulted in frustration and you will squandered date. Just minutes into home loan pre approval processes today, could save you days afterwards on to purchase procedure. A pre-approval will bring a definite picture of your house amount borrowed you be eligible for, allowing you to appeal your research on the characteristics affordable.

step 3. Score a credit history Consider

Your credit rating performs a crucial part during the determining the interest price and terms of your own mortgage. In advance of seeking pre-approval, get a credit history to evaluate their rating. In case the rating needs upgrade, take steps to compliment it before applying. A higher credit history not merely increases their approval and boosts the regards to the home loan.

4. Keep the Mortgage Pre-Recognition Page Helpful

After you’ve acquired their pre-recognition page, approach it particularly a fantastic admission. Your own financial preapproval letter try a proper file from the financial saying maximum loan amount your qualify for. Ensure that it stays handy via your home browse, as it shows their seriousness once the a purchaser and you will strengthens the settlement position which have vendors.

5. Recognize how Enough time Pre Approval Lasts

Home loan preapprovals keeps a rack-lives. Understand termination time on your pre-recognition page. Generally speaking, pre-approvals try valid to own 60-3 months, however, this may will vary certainly one of loan providers. Whether your house browse expands past this era, speak to your lender having an extension. Looking after your pre-acceptance latest ensures that you are nevertheless qualified to receive new very first recognized loan amount.

What’s Home financing Pre-approval?

An effective pre-approval are a primary analysis of the a lender that identifies the newest matter they are prepared to give your to possess a home get. This action relates to a comprehensive writeup on your financial situation, including your earnings, credit rating, assets, and debts. The lender evaluates this particular article to select the restrict matter you qualify for, the possibility mortgage loans available to you, additionally the relevant interest rates.

Financial Pre-recognition Vs. Prequalification

One another home loan prequalification and you can preapproval suffice the objective of estimating the loan amount you could qualify for. Although not, they differ rather regarding depth and you will reliability:

Home loan pre-degree is a casual investigations by the a lender, counting on the brand new financial pointers your offer. It has a quotation regarding how much you will be in a position to help you obtain. But not, it is not once the comprehensive since the a good pre-recognition as it does not cover an out in-breadth investigation of one’s credit report otherwise verification of financial records.

Pre-recognition, while doing so, try a more robust review. Lenders scrutinize debt information also borrowing pointers, money, property, and you may monthly expense, to procedure good conditional connection to have a certain home mortgage amount. A great pre-recognition retains more weight about sight away from providers because it suggests a sophisticated regarding relationship and you will depend on in your function in order to safe financial support.