What things to discover before using a consumer loan since the a home deposit

Must i play with that loan because in initial deposit to have a home?

Even though the preserving to have in initial deposit create continually be preferable, we know it’s just not usually you’ll or can take many years at best.

Rents during the list levels and you may rising house costs are so it is all the more hard for of numerous ambitious consumers to store sufficient to have a great meaningful deposit.

This which is the best bank for personal loans in New Jersey past year the common very first-big date customer deposit in the united kingdom is actually an impressive ?53,935. You to figure tend to definitely consistently increase, therefore once you have actually managed to help save you to definitely count, the goalposts might provides gone.

In short, yes; one may play with a personal bank loan since a deposit to have property, not of numerous lenders deal with that it, and you will expect to have large list of solutions in the event the you finance your put from other present.

How does playing with a personal bank loan to have a deposit to possess an excellent domestic performs?

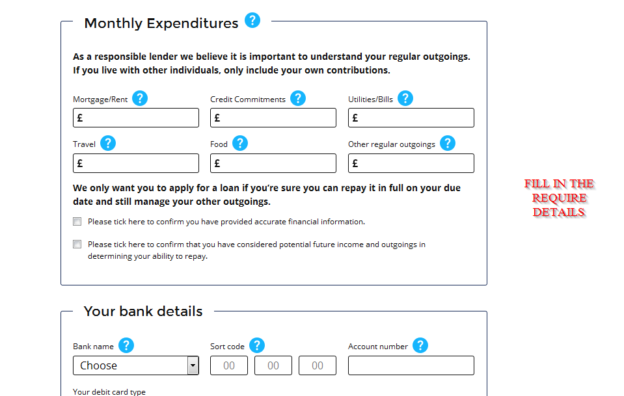

Make an effort to consider the monthly charges for both the financial additionally the unsecured loan, the mortgage vendor will also make up these two repayments when evaluating your affordability.

Before applying for a financial loan, it is worthy of examining with a mortgage broker such as for instance Challenge on which perception any coming financing costs might have on the affordability. They are going to plus find out if you be eligible for the lenders one to imagine dumps funded from the unsecured loans. The last thing for you to do is actually take out an excellent loan just to realize you simply can’t get a home loan.

It is worth bringing up that every mortgage lenders think about the monthly payment of your own financing as opposed to the a great harmony when determining value.

Unsecured loans are offered over regards to step 1-seven years. As the getting a loan more a smaller identity will ensure you spend quicker attention total, a shorter mortgage label that have a high monthly payment can get a more impressive affect your own home loan value compared to the one to give more a longer time.

Particularly, a great ?ten,000 personal loan spread-over eight-12 months title at 5% is ?141 a month versus ?300 more than three years. This might generate a big difference towards the amount you can borrow secured on a home loan.

Most mortgage lender requirements state that the non-public mortgage must be pulled that have a unique business about home loan supplier. The maximum amount you could usually borrow on a consumer loan try ?25,000, as the matter you can obtain will depend on the value and credit score.

Minimal put to own home financing try 5% of the home well worth, although put expected depends upon the fresh lender’s criteria and you can your put. Make use of the private mortgage to cover particular otherwise all the of one’s deposit.

Is utilizing a loan getting a deposit a good idea?

This depends on your items additionally the possibilities to your. Attempt to assess the total costs of the financial and you will loan payments and you may compare them to what you’re already investing in lease and you can protecting to possess in initial deposit.

Such as for example, whether your book try ?1,000 monthly and you are clearly saving ?3 hundred 1 month having a deposit, your total prices are ?1,three hundred a month. Let’s assume the mortgage try ?900 therefore the financing ?250 a month, you will be ?150 four weeks better off each month.

How full costs examine tend to needless to say, trust their deposit top, home loan label, interest rates and you will latest level of outgoings.

Even if the will cost you of financial & financing are higher than your outgoings, you may still determine to get ’s the best choice as you have a tendency to own a property and start to become chipping aside at your very own mortgage in the place of paying their landlord’s home loan regarding.