There are various some thing a lender need think prior to giving their app for a loan

LTV is actually two amounts one compare the worth of that loan on worth of the house the mortgage will be utilized getting. Including, when you need to get a home worthy of $400,000 and also you you need that loan having $3 hundred,000, your LTV was 75 % just like the loan really worth, $300,000, are 75 percent of one’s property value the $eight hundred,000 house. The greater the new LTV the greater the mortgage otherwise financial you need certainly to buy a house.

The brand new LTV is known as because of the loan providers is an effective indication of one’s riskiness out-of a debtor. A high LTV form greater risk towards the lender. A low LTV (elizabeth.grams. thirty-five percent) demonstrates youre a quicker high-risk debtor. On perspective of a lender, a reduced LTV shows that you have generated otherwise conserved sufficient currency to manage all the pick oneself, and therefore you are probably top capable keep up with the loan’s requisite repayments as compared to people with high LTV. A top LTV can occasionally end up in highest rates and costs for a financial loan or mortgage due to the added top regarding exposure toward bank.

By once you understand their LTV, it is possible to make a knowledgeable guess about what kinds of fund you could potentially located from different loan providers.

Major financial institutions such as for example finance companies and you will Borrowing from the bank Unions assess a combination LTV as well as your credit history and you can, money to decide while you are entitled to recognition regarding a beneficial financing otherwise financial.

Personal Mortgage Lenders approve money based on household guarantee alone, and additionally they use LTV to determine if you meet their demands.

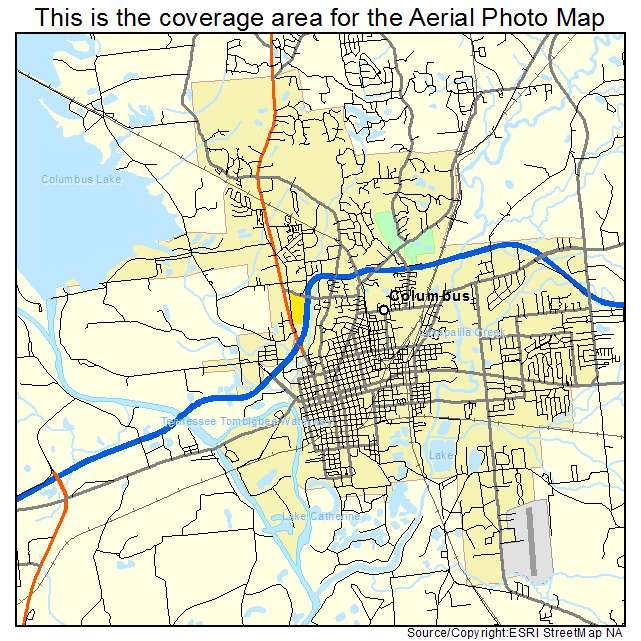

If you find yourself biggest financial institutions keeps several conditions to possess financing recognition, personal loan providers want your home security and make use of the spot of your home to choose the limit amount of security you could potentially used to keep the financing.

Organizations that have a populace lower than 30,000 are believed short cities. For those who residence is for the a small city, personal loan providers can be secure finance to 65 percent of home’s LTV.

Mid-sized places have a people anywhere between 30,000 and you may two hundred,000 that have large cities with 200,00 in addition to people. Private lenders provide fund up to seventy percent of home’s LTV for the middle-measurements of metropolitan areas or more so you’re able to 75 percent LTV in the high metropolises.

Remember the LTV merely an assessment of property value your property and also the mortgage your safer on it. Since you pay back the home loan or financing your LTV tend to drop.

Into LTV calculator you will discover for individuals who meet the requirements having a personal mortgage and exactly how far you can acquire built on the house security. This information makes it possible to most readily useful discuss that have a fair package with a lender.

Loan-To-Value Proportion Calculator

Knowing what sort of financial support you can purchase and you can exactly what it costs every month helps you get ready a spending budget to control your expected money, reducing the possibility you skip or build a later part of the commission.

In order to estimate their LTV, proceed with the simple actions from the LTV calculator. Enter the projected worth of the house you are looking for, your asked amount borrowed, therefore the type of financial you prefer on the around three text sphere less than, after that click on the key Determine Your loan-To-Worth Ratio‘. The calculator will give you an easy influence.

What’s a loan-to-Worth Ratio?

That loan-to-Worthy of proportion to have a house is equivalent to all of the mortgage loans to your a home split of the assessment value of the house. For folks who own a house value $1,000,000 and also another first mortgage to own $750,000 after that your LTV ratio try 75% (we.e., 750,000/1,000,000)

Most banking companies or any other Good-Tier Loan providers can also be mortgage around 95% LTV so Shelby bad credit loans long as the newest debtor have good income and you will credit get. Extremely low-bank loan providers normally lend around 75% LTV but could overlook income and you can borrowing points.