You may even be eligible for a special reasonable loan for individuals who are generally in the foreclosures

Family Affordable Refinance System – Your house Affordable Re-finance system could be open to five to four billion people that a substantial commission background to your an present financial owned by Federal national mortgage association or Freddie Mac computer. Generally, these individuals could well be incapable of refinance as their home features shed worth, pushing their latest financing-to-worthy of percentages more than 80%. Beneath the House Reasonable Refinance system, many usually now qualify so you’re able to re-finance its financing when planning on taking advantage of the present all the way down financial rates or even to refinance an adjustable-rates mortgage on the a secure financial, instance a thirty-seasons fixed rate mortgage. Lenders and you may mortgage servicers actually have the majority of the newest borrower’s suggestions towards document, so records criteria americash loans Louviers are not going to become difficult. In addition, occasionally, an assessment are not required. So it self-reliance could make the new refinance faster and less expensive to possess both consumers and lenders. The house Reasonable Refinance program results in .

Domestic Affordable Amendment System – The house Reasonable Amendment program can assist around three so you can five mil at the-risk homeowners prevent property foreclosure. Monthly mortgage repayments might be decreased by eliminating the interest rate to the present accounts or of the stretching brand new money so you can forty many years in the place of 31. The prominent number paid off remains the same, but the borrower pays quicker focus otherwise takes offered to invest from the mortgage. This really is a voluntary program. Handling the newest banking and you can borrowing commitment bodies, the latest FHA, new Virtual assistant, the fresh new USDA while the Federal Houses Fund Service, the latest Treasury Service now established system recommendations which can be expected to getting simple industry habit into the pursuing affordable and you will green mortgage modifications. This choice are working in conjunction having a broadened and you can increased Expect Homeowners system. This program pertains to:

In the event the newest financial balance is at or lower than one to matter, you will probably qualify for the applying and ought to contact your lender to find out if they participate in the application

Servicers agrees with a specified succession off steps in acquisition to reduce the payment in order to only about 29% of borrower’s gross month-to-month income. Stick to the measures lower than to choose in case your 30% regarding month-to-month money conditions will meet the requirements you to own a special affordable financing.

Step 2 Multiply this new monthly income from the 0.29 to determine the restrict percentage you can get as opposed to exceeding the fresh 29% conditions.

Step 3 Request that loan amortization desk based on the current rate of interest and find out the borrowed funds prominent into the payment computed during the 3. There are also several home loan hand calculators available online that will help using this type of step.

Step four In the event the most recent financing are below the quantity computed for the step three, you will probably meet the requirements and must contact your lender to find out if he could be participating in it voluntary authorities program.

Example: Their yearly money are $40,000, while the most recent home loan interest rate try 5.25%. The fresh new $forty,000 annual income means a monthly income regarding $3,333 ($forty,). The most mortgage payment you’ll have less than this plan is $step one,033 ($step three,333 x .31). According to research by the 5.25% rates calculated away from a home loan dining table otherwise loan calculator, the new $step one,033 payment will service a good $187,000, 30-seasons mortgage.

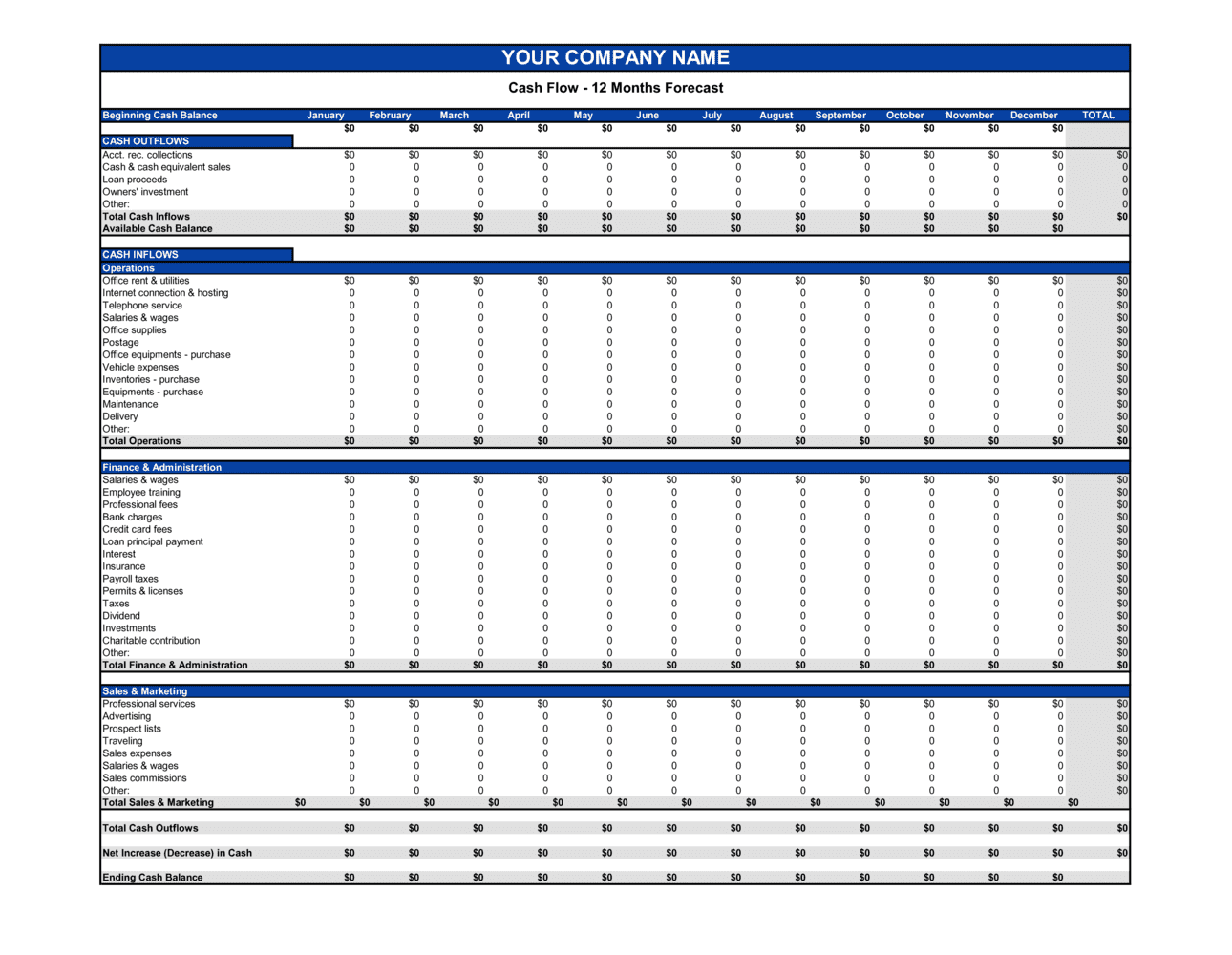

The fresh table less than depicts the newest qualifying mortgage repayments and you may resulting loan number centered on 5.25% rates of interest (the current rate at the time this article is composed) and lots of amounts of income. Overall performance portrayed are different with assorted interest rates.

However, you’ll have to demonstrate that you may be a fair credit risk pursuing the reduced amount of prominent

If the, after lowering your rate and you may stretching out your instalments, you will still don’t have sufficient income to meet up with you to definitely 31% threshold, the plan probably will not do the job.

Of numerous property owners provides mortgages bigger than the value of their home. Certain lenders, rather than property foreclosure, are willing to negotiate a reduction of the main in place of sustain the expenses of this foreclosing and you will reselling the house. Think about it; might reduce the new drop home based worth either way. Contact your bank to discover if they have a course like this offered.