The advantages and you can Disadvantages from Whenever a Virtual assistant Financing

Those anyway interested in a residential property always observe this new slow creep out of financing interest levels. For now, this new pricing is becoming aggressive, but financing gurus expect interest rates to increase from inside the then days. And in case a Va Loan you’ll become an appealing solution throughout the not too distant future for military disability loans fast homebuyers and sellers.

Prior to plunge for the pros and cons from if in case Virtual assistant mortgage, listed here is an easy note from what an effective Va mortgage expectation is and you may who is qualified.

- Whenever an effective Va financing compatible seizing the loan regarding a citizen in place of checking out the much time and you will expensive process of applying for a new mortgage. There is documents, but it is specifically made to possess an excellent Virtual assistant financing assumption.

- Virtual assistant loan presumption isn’t limited to productive obligation participants and you can veterans. Anybody who the lender deems qualified to take on new fee count is eligible for taking along side mortgage.

Related: Your own Virtual assistant Financing is considered the most your own most valuable army masters, and you will good Va Online calculator is a wonderful location to get been. Follow this link so you’re able to determine the speed in minutes.

Mainly based while our home client otherwise family seller, you will find causes for both and against assuming an effective Va loan. People need to carefully consider every mortgage options, as the and in case an excellent Virtual assistant loan may well not work with the like. Contacting financing pro which have Va loan presumption experience is extremely needed.

- If the Va loan was assumable, it negates the necessity to make an application for another type of loan. The consumer normally stop investing closing costs and you will assessment charge, likely saving several thousand dollars.

- An initial time Va mortgage affiliate pays normally an excellent 2.15% Virtual assistant investment payment, another-date Va mortgage representative will pay a great deal more, but the Virtual assistant just costs good 0.5% money fee into the loan amount for the expectation, which is less as compared to other charges.

- In the event your fresh Virtual assistant mortgage are acknowledged at an extremely low interest, there is certainly a high probability another mortgage will have a top rate of interest. Like, when your loan was centered having a fixed rate off step 3.31% in 2011, along with 2018 the best Virtual assistant loan interest comes in in the 4.30%, it’s not hard to understand the savings make sense into the client.

- Virtual assistant manufacturers provides a bonus in the event the above state takes place, just like the purchasing pond grows to incorporate people who manage imagine incase a good Va mortgage. Vendors commonly sector the brand new of good use interest because the a deals function when you look at the residence’s advertisements.

- Va money assumed of the seasoned people keep less of a threat to your merchant as their complete Va financing pros is actually returned.

- The buyer need certify your loan presumption is for a good top residence as long as they would like to change Va housing entitlements to the merchant.

- If the a civilian consumer assumes on the Va mortgage, the rest part of the seller’s Virtual assistant entitlement being used stays into the modern loan. The fresh new seasoned don’t retrieve the rest qualifications before financing was paid. This is going to make a short marketing or foreclosures from the civilian holder something to envision, once the experienced proprietor will lose that percentage of its work with.

To find out more on down money and you may guarantee of this a Va financing assumption, review 4 Common Questions relating to Virtual assistant Financial Expectation.

Adopting the means of presumption is accomplished, it is necessary your unique Virtual assistant vendor see its Discharge of Accountability mode. Which document assures the vendor is not responsible for the original loan down the road in addition to amazing terms of the borrowed funds citation to the buyer.

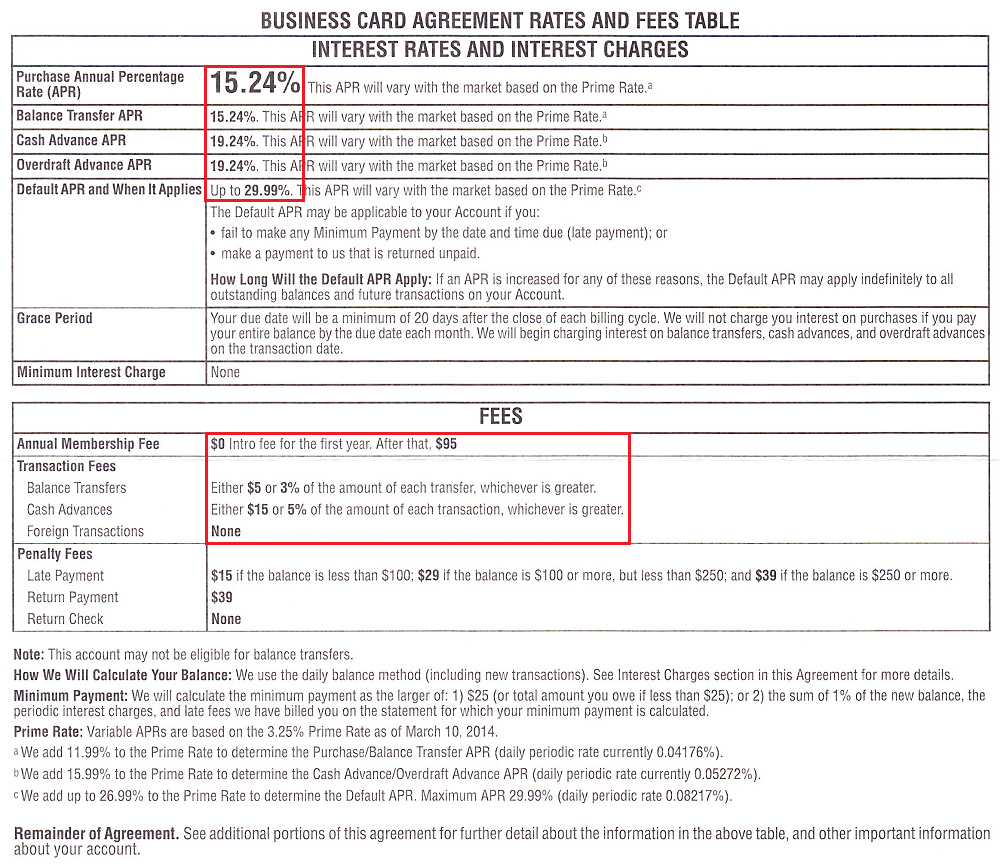

Prior to and when that loan, you should compare their terms and conditions that have most recent rates

Va mortgage presumption is one of many selections home buyers supply now. Our home to invest in see should always begin by an abundance of research into subject areas particularly location and you can cost, finances, and you can home ownership requirements. MilitaryByOwner is the best vendor out of military life associated a residential property info.

You can help save substantially more from the acquiring another type of mortgage alternatively than and in case an adult, higher-desire financing

One of the most powerful reasons to not guess an existing Virtual assistant mortgage is the fact, for the majority of, the modern interest ecosystem is far more attractive as compared to terminology into an existing financing. You can expect to five rate quotes out of fighting loan providers having zero obligation with no credit check.